Smart Tips About How To Buy A Tax Lien Certificate

Is this possible in the first place?

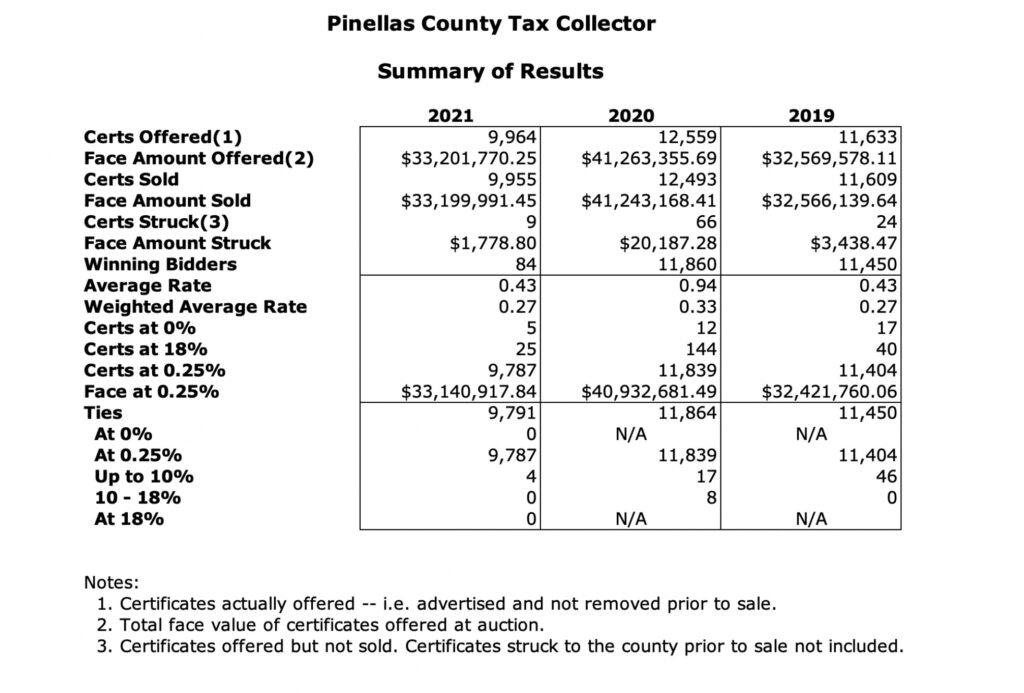

How to buy a tax lien certificate. The amount of the certificate is the sum of the. Each locality will run tax lien auctions slightly differently, but the overall process involves bidding on the certificate to the lien. Copies or search for ucc/tax lien filings.

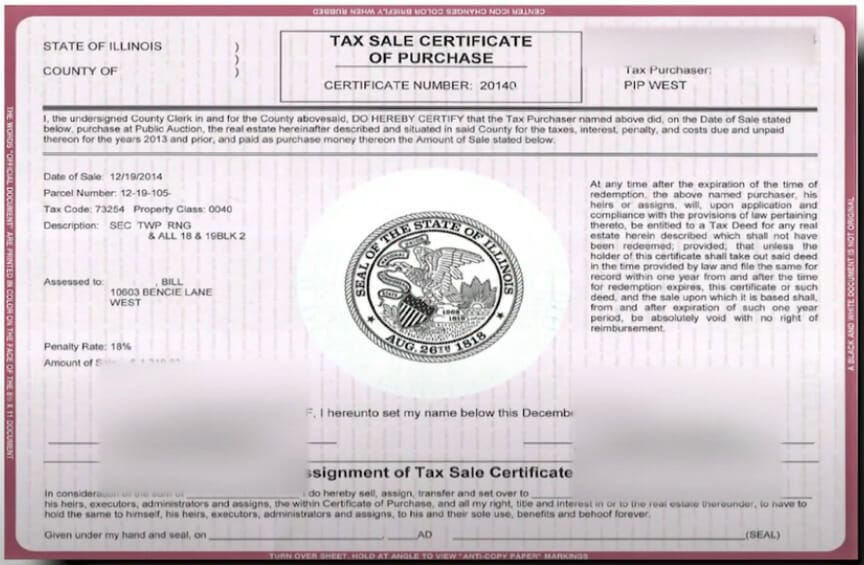

Requests must be made on the information request form (ucc11). The winning bidder at the public tax lien auction receives a tax lien certificate as proof of purchase. In illinois, they call it a “scavenger list.”.

You are not buying a property in maryland. How to buy a tax lien certificate: Interest accrues on the tax certificate from june 1 until the taxes are paid.

That means the tax lien certificate was not purchased, but you can go. Are you wondering how to buy tax lien certificates in california? They sell a redeemable tax deed, which the minimum.

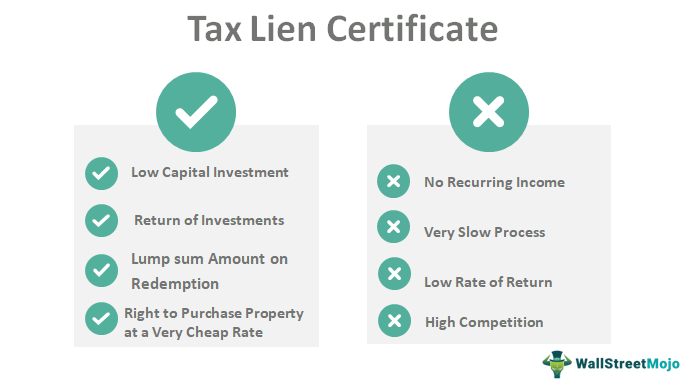

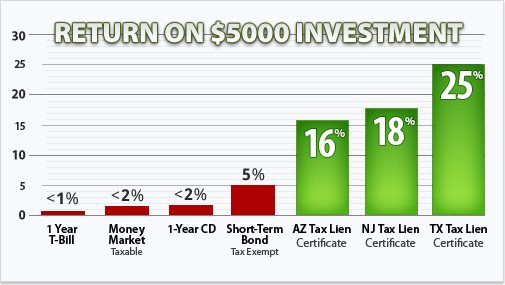

Anyone can buy tax lien certificates. As the owner of the tax lien certificate the investor may expect one of two possible. How to invest in a tax lien certificate?

Tax liens may be imposed on a property for the purpose of collecting outstanding debt on the property. Whether you have $100 or $100,000, there’s a tax lien certificate available to suit your budget. A tax lien certificate is a certificate of claim against a property that has a lien placed upon it as a result of unpaid property taxes.

/GettyImages-CA21828-a19376e37c97499799e45f8aa4940dd3.jpg)